Buy Now Pay later | Line of Credit

Buy Now Pay later | Line of Credit

Co-Lending

Co-Lending

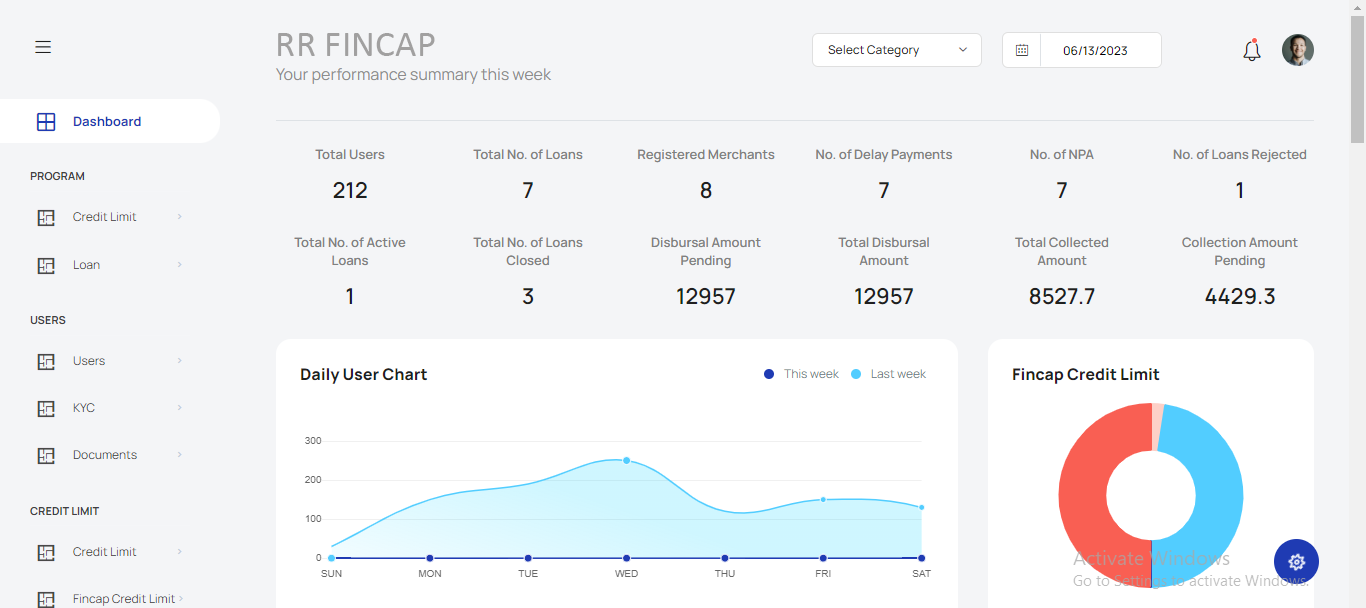

Reporting Dashboard

Reporting Dashboard

Flexible Loan Product Constructs

Flexible Loan Product Constructs

Co-Lending

Co-Lending

Marketplace Integration

Marketplace Integration

Extensive Third Party Integrations

Extensive Third Party Integrations

Secure Open API

Secure Open API

CISA certified for RBI Infosec compliance

CISA certified for RBI Infosec compliance

Industry standard authorization protocol

Industry standard authorization protocol

Encryption of sensitive data (AES-256 Encrypted)

Encryption of sensitive data (AES-256 Encrypted)

Credit Bureau data exhange and Basel III banking standards

Credit Bureau data exhange and Basel III banking standards

In simple terms, a loan management system can be understood as a software solution that allows you to manage your entire loan cycle efficiently. By leveraging the RR Fincap LMS, you can orchestrate a faster market launch, design consumer friendly lending products and stay compliant with local and international rules all the way through.

The advantages of a loan management system are endless, right from making your lending process easier via automatic credit checks, accurate customer assessments, a completely online and paperless process to helping you accurately visualize your ROI via streamlining your entire lending process.

The challenges of implementing a loan management system are few and far between. Although it might seem like a daunting task at first glance, in reality, ' 'today's Loan Management Systems arrive with ease of access, right out of the box, meaning you can start experiencing the countless benefits of one within no time. Along with this, since most architectures are completely cloud-based and offer real-time support, you will save an additional amount of time in installation, and issues you run across will get resolved in no time.

Modern Loan Management Systems arrive with seamless integrations, which allow for a seamless and effortless transition from a legacy system to a modern loan management system. Along with this, most companies offer onsite installation and integration support, meaning you can sit back and relax while the experts upgrade your system and migrate your entire loan portfolio to a system designed for the customers of tomorrow.

Although the fundamentals of most lending institutions are consistent, we completely agree that every business need is unique, and thus RR Fincap's LMS arrives with complete customizations on top of its inherent features. To help us understand your business needs and our solutions, speak to our business executive today.

The timeline to implement a modern loan management system and import your entire portfolio from a legacy system generally ranges from 1 to 5 business days, depending on our exact requirements.

As all our offerings are customized from the ground up for every lending institution, our charges tend to vary. To arrive at an accurate estimate, please speak to our business executive today.